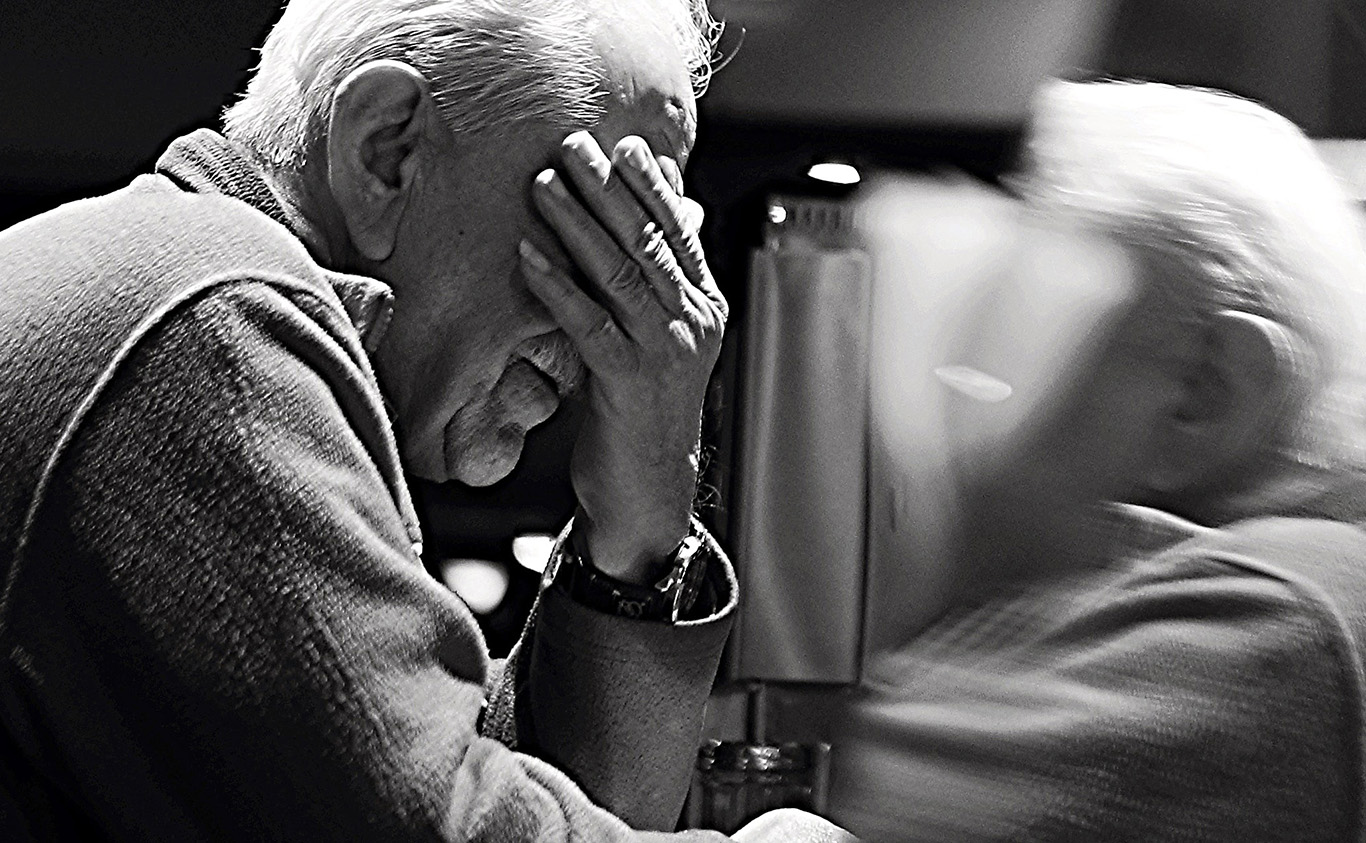

Aged Care COVID Crisis

During the coronavirus pandemic residential aged care has been hit very hard. By the beginning of August we have seen over 1,000 cases of coronavirus in residential aged care, and over 160 deaths. And this is an industry already in the middle of a Royal Commission and plagued by a multitude of negative headlines.

The aged care industry is moving from crisis to crisis.

Given residential aged care has been in the spotlight for almost six months we looked at how people’s confidence and intentions towards residential aged care may have changed since the outbreak of the coronavirus.

The reality is that while none of us want to go into aged care, 58% of people said they are unable to care for an elderly person at home. The main barrier to being able to care for people is not having the right skills or resources.

As we age, we are more likely to have mobility issues, chronic health conditions and to suffer from dementia or alzheimers. It takes specialist skills and resources to properly care for people with these health issues. That makes aged care an essential service that we must get right.

We conducted a nationally representative survey with 1,000 people, data was weighted to ABS statistics and sourced from an independently tested research panel. The survey was conducted from Friday 31 July to Monday 3 August.

The survey findings were very clear

Confidence in aged care has dramatically declined

- Since the outbreak of COVID-19 53% of the Australian adult population say their level of confidence in aged care has decreased

- 1 in 4 people (23%) who have a friend or relative in aged care say that person’s mental health has declined since COVID-19 – this increases to 1 in 3 (34%) for people who are in aged care in Victoria

Structural issues are at the core of the problem

- One in three people (36%) say the greatest issue with aged care that puts elderly residents health at risk is the casualisation of the workforce, forcing many people to have to work across multiple aged care centres to earn a decent income

- The second biggest issue putting resident’s health at risk is the low carer to resident ratios (25%)

The Government is not believed to be doing enough

- 49% of the Australian adult population do not believe the Government is doing enough to ensure aged care providers are protecting residents from COVID-19

Given the decline in confidence and structural issues with residential aged care, we explored what implications this might have on people’s future intentions

Since COVID-19 a significant number of people are looking for alternatives to residential aged care for their loved one

- 54% of people who have a loved one in aged care are currently considering taking that person out of care – 2 in 3 people say this would be a temporary move, while the remaining 1 in 3 are considering making this a permanent move

- 60% of people who were planning to move someone into aged care in the next 5 years before COVID-19 will either delay that move or try to avoid aged care all together

- 31% of the people who were considering moving someone into aged care in the next 5 years are now looking to delay that move

- 14% say they will no longer move that person into care they will look to source services to keep that person in their own home for as long as possible

- 15% will try to care for that person at home

We are still in the middle of the coronavirus pandemic, and no doubt we will see many more residents of aged care facilities diagnosed with and die from COVID-19.

We need to re-think the aged care model and be more creative and innovative with ways in which we can support families to care for the elderly – and not wait until the pandemic has completely eroded what faith we have left in the system.